Simply take the dividend per share and divide by the FFO per share. The greater the yield the much better. Strong management makes a distinction. Try to find business that have been around for a while or a minimum of have a management group with loads of experience. Quality counts. Just buy REITs with excellent properties and renters. Think about buying a shared fund or ETF that buys REITs, and leave the research and buying to the pros. As with all financial investments, REITs have their advantages and disadvantages. One of the greatest benefits REITs have to provide is their high-yield dividends. REITs are required to pay 90% of taxable income to investors; hence REIT dividends are often much greater than the average stock on the S&P 500.

Few individuals have the ability to head out and buy a piece of commercial realty in order to create passive income, however, REITs use the public the capability to do precisely this. How to buy real estate with no money down. Additionally, purchasing and offering genuine estate typically takes some time, binding cash circulation while doing so, yet REITs are highly liquidmost can be purchased or sold with the click of a button. There are some drawbacks to REITs of which financiers need to know, most especially the possible tax liability REITs can create. Most REIT dividends do not satisfy the Internal Revenue Service meaning of "competent dividends," indicating the above typical dividends offered by REITs are taxed at a greater rate than most other dividends.

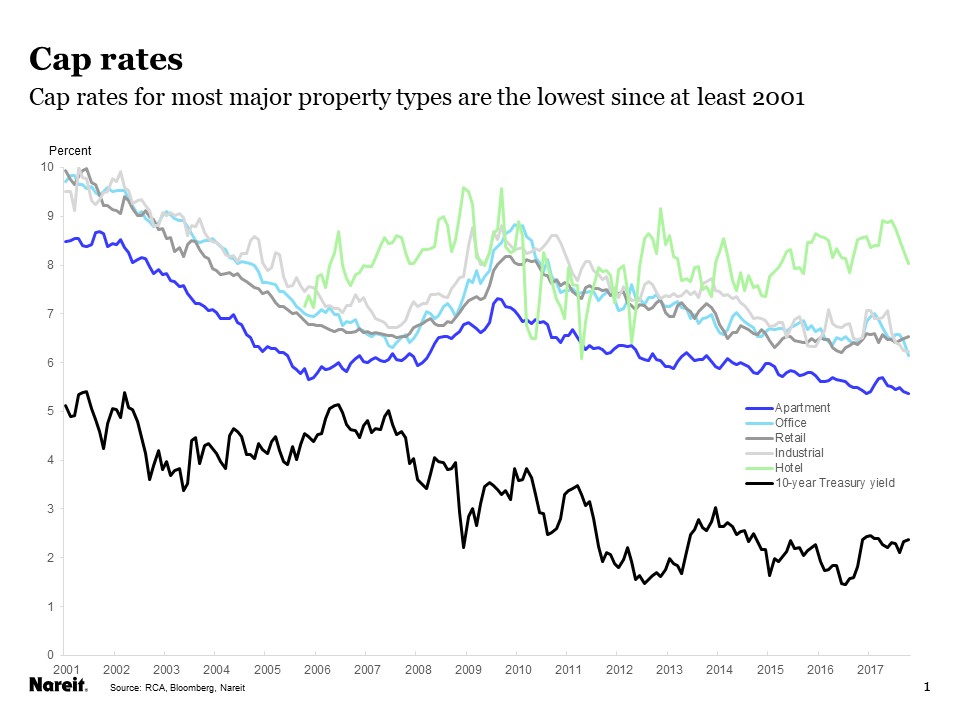

Another prospective concern with REITs is their level of sensitivity to rates of interest. Typically, when the Federal Reserve raises rate of interest in an effort to tighten up costs, REIT costs fall. Furthermore, there are residential or commercial property particular threats to various kinds of REITs. Hotel REITs, for instance, typically do exceptionally improperly throughout times of financial failure. Pros High-yield dividends Portfolio diversity Check out here Highly liquid Cons Dividends are taxed as normal income Level of sensitivity to rates of interest Dangers associated with particular residential or commercial properties Buying REITs is a great way to diversify your portfolio outside of conventional stocks and bonds and can be appealing for their strong dividends and long-lasting capital gratitude. What is a real estate developer.

Excitement About What Is Steering In Real Estate

Buying REITs through a REIT ETF is an excellent way for investors to engage with this sector without needing to personally compete with its complexities. Because REITs are required by the Internal Revenue Service to payout 90% of their taxable income to investors, REIT dividends are typically much higher than the typical stock on the S&P 500. Among the very best methods to get passive earnings from REITs is through the compounding of these high-yield dividends. Just like any investment, there is constantly a danger of loss. Openly traded REITs have the specific threat of losing worth as interest rates increase, which typically sends investment capital into bonds.

Purchasing other kinds of property such as health care or retail, however, which have longer lease structures and thus are much less cyclical, is a great method to hedge against an economic downturn. The federal government made it possible for financiers to buy into massive business property projects as far back as 1960. However, just in the last years have private financiers embraced REITs. Factors for this include low-interest rates, which forced investors to look beyond bonds for income-producing financial investments, the arrival of exchange-traded and mutual funds concentrating on property and, up until the 2007-08 real estate disaster, an insatiable appetite on the part of Americans to own realty and other tangible assets.

Realty financial investment trusts (" REITs") allow people to buy large-scale, income-producing property. A REIT is a company that owns and generally runs income-producing realty or related properties. These may include office buildings, going shopping malls, homes, hotels, resorts, self-storage facilities, storage facilities, and home loans or loans. Unlike other property business, a REIT does not develop real estate residential or commercial properties to resell them. Instead, a REIT purchases and establishes homes primarily to operate them as part of its own financial investment portfolio. REITs offer a way for specific financiers to make a share of the income produced through commercial realty ownership without really having to go out and purchase commercial real estate.

The Basic Principles Of What Does A Real Estate Lawyer Do

These are called publicly traded REITs. Others may be signed up with the SEC however are not openly traded. These are called non- traded REITs (likewise understood as non-exchange traded REITs). This is one of the most important differences among the different sort of REITs. Before investing in a REIT, you must comprehend whether it is openly traded, and how this might impact the benefits and dangers to you. REITs offer a method to include real estate in one's financial investment portfolio. Furthermore, some REITs may use higher dividend yields than some other financial investments. But there are some threats, specifically with non-exchange traded REITs.

They generally can not be offered easily on the free market. If you need to offer an asset to raise money quickly, you may not have the ability to do so with shares of a non-traded REIT. While the marketplace cost of a publicly traded REIT is readily available, it can be tough to figure out the worth of a share of a non-traded REIT. Non-traded REITs typically do not offer an estimate of their value per share up until 18 months after their offering closes. What is wholesaling real estate. This may be years after you have actually made your financial investment. As an outcome, for a significant time period you may be not able to evaluate the worth of your non-traded REIT financial investment and its volatility.

Unlike openly traded REITs, nevertheless, non-traded REITs regularly pay distributions in excess of their funds from operations. To do so, they might use offering earnings and borrowings. This practice, which is generally not used by openly traded REITs, lowers the worth of the shares and the money offered to the business to purchase extra properties. Non-traded REITs usually have an external supervisor instead of their own employees. This can result in possible conflicts of interests with shareholders. For instance, the REIT might pay the external Go to this site supervisor substantial charges based on the quantity of property acquisitions and properties under management. These cost rewards might not always line up with the interests of investors.

Some Ideas on Which Combines Google Maps With Real Estate Data You Need To Know

You can purchase shares of a non-traded REIT through a broker that gets involved in the non-traded REIT's offering. You can likewise purchase shares in a REIT buy timeshare mutual fund or REIT exchange-traded fund. Publicly traded REITs can be acquired through a broker. Usually, you can purchase the typical stock, chosen stock, or financial obligation security of an openly traded REIT. Brokerage charges will use. Non-traded REITs are usually sold by a broker or financial consultant. Non-traded REITs normally have high up-front costs. Sales commissions and upfront offering charges generally amount to roughly 9 to 10 percent of the investment. These costs lower the value of the financial investment by a significant amount.